A Winter 2026 Guide For JBLM-Area Homeowners

James Marszalek, Director of Sales & Client Strategy, Operation Red Dot

Moving in the South Sound comes with big decisions, especially in today’s changing market. For area and out-of-state residents, military families, and veterans… whether you are moving due to military orders, relocating for work, or you’re making lifestyle changes, you may be asking:

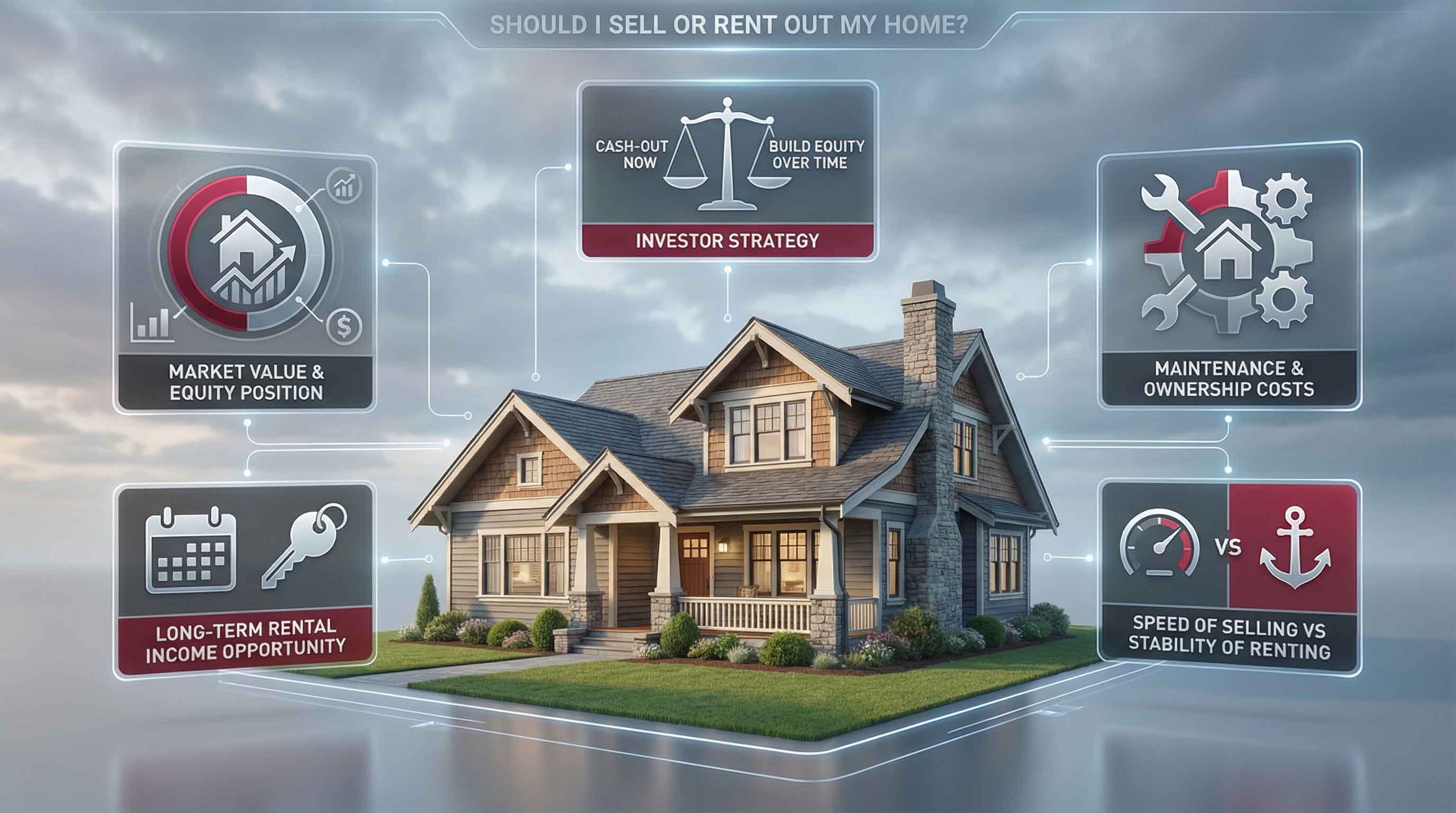

Should I sell my home or rent it out?

THIS Winter brings unique conditions. Interest rates have leveled off, buyer demand is steady but selective, and well-kept homes can attract strong interest. At the same time, rental demand around JBLM, Tacoma, Lacey, and Dupont remains high, especially near good schools and easy commute routes.

As a veteran-owned local brokerage, we help homeowners weigh both paths, so you feel confident and supported, not rushed.

What Winter 2025-2026 Means for Homeowners

If You Sell Now…

Winter buyers tend to be serious and ready to move. You may consider selling if:

- You want access to equity for your next move or investment

- Your home is move-in-ready and priced well

- You don’t want to manage a property long-distance

- You’re transitioning out of the area for good

We’ll help you estimate your net return by assessing:

- Your property’s condition

- Closing costs

- Fees and taxes

- Your equity and potential gains

If You Rent Out Your Property Now

If you’re not ready to part with your home, renting can help you:

- Build long-term wealth while someone else pays down your mortgage

- Keep the option to return to the South Sound later

- Wait for a more favorable seller’s market

Rental demand near JBLM is strong, especially in:

- Lacey / DuPont / Steilacoom

- South Tacoma & Spanaway

- Yelm / Roy / Graham

A good rental candidate usually has:

- A desirable location or commute

- Solid condition with limited repair needs

- Strong rent-to-mortgage potential

A property management team can handle tenant placement, maintenance coordination, and compliance, making renting more hands-off than many owners expect.

When Selling Later Might Make Sense

Consider selling down the road if:

- Mortgage rates drop and competition for housing heats up

- Repairs and maintenance are eating into profits

- Market prices rise again and you want to capitalize

- You’re ready to reinvest into another home or market

We’ll help watch market timing so you don’t miss opportunities.

What About Tax Benefits?

Homeowners today have smart tools to protect profits and plan ahead, including:

- Depreciation planning for rentals

- The option to move back in later to reduce tax burdens

- 1031 exchanges to defer capital gains if reinvesting

- Owners can also write off repairs, improvements, and costs associated with management.

We can connect you with vetted tax pros and guide the real-estate side of the strategy.

Choosing Mid-Term vs. Long-Term Rentals

We’ll help explore both options:

Short-Term Rentals

Higher income potential, more involvement, depends on local rules.

Long-Term Rentals

Steady rent, simpler to manage, strong JBLM tenant pool.

Either way, tenant screening is key. Background checks, income verification, and rental history help protect your property and peace of mind.

A Local Team You Can Trust

Whether you decide to sell, rent, or explore both paths, you don’t have to figure it out alone.

At Operation Red Dot, we support area, out-of-state and military families making smart housing decisions across Pierce and Thurston counties. Our team brings real experience, clear guidance, and straightforward support – because these choices matter.

Ready to Decide? We’re ready to help you! Let’s Connect!

Choosing whether to sell or rent a home is a major undertaking and step in your life. At Operation RedDot, our expertise lies in crafting a tailored housing plan of action for military personnel and veterans and families near JBLM.

Contact us today for a free property analysis so that we guide you to take the next with the confidence that you’ll be making, and taking, the right steps toward financial freedom and make the uncertainty of selling or renting a more straightforward process with information and our expertise by your side.