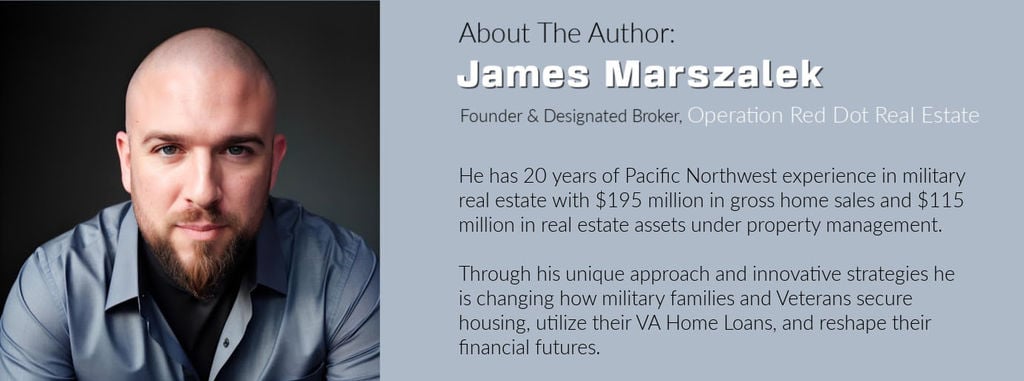

James Marszalek, Director of Sales & Client Strategy, Operation Red Dot

When most buyers worry about overpaying for a home, they’re usually thinking about one thing: “Will the appraisal come in at the right value?”

But the bigger risk often shows up months or years later, long after the deal closes.

In fast-moving markets like the South Puget Sound region, including areas near JBLM, Tacoma, Puyallup, Lacey, Yelm, and Olympia, buyers can “win” a house and still lose financially, emotionally, or strategically over time.

Overpaying isn’t always about paying too much on paper. It’s about buying a home that limits your options later, or uncovers hidden costs that couldn't be seen during the purchase.

Overpaying Doesn’t Always Mean Paying Above List Price

Many buyers assume overpaying only happens when someone bids far over asking. In reality, buyers can overpay even when they purchase at or below list price.

Overpaying happens when:

- A home doesn’t hold value as expected

- Future resale or rental demand is weaker than assumed

- Maintenance costs eat into long-term affordability

- Life changes force a move sooner than planned

The risk isn’t obvious on closing day, but it becomes very real later.

Why Buyers Overpay Without Realizing It

Most buyers don’t overpay because they’re careless. They overpay because they’re missing information or feeling pressure.

Common reasons include:

- Focusing on Monthly Payment Instead of Long-Term Cost

Low interest rates or creative financing can make a home feel affordable now, even if the purchase price stretches future flexibility.

- Confusing “Winning” With Making a Good Decision

In competitive markets, buyers are often encouraged to focus on beating other offers instead of evaluating long-term value.

- Underestimating How Life Can Change

Job changes, family growth, relocations, or PCS orders can arrive sooner than expected. A home that works today may not work later.

- Ignoring Micro-Location Differences

Two homes in the same city can perform very differently depending on neighborhood demand, access, noise, schools, and future development.

The Hidden Costs That Turn a “Fair Price” Into Overpaying

Even when a price looks reasonable, long-term costs can quietly turn a good deal into a bad one.

Smart buyers consider:

- Maintenance reality (what breaks first, and how often)

- Property tax, insurance, and HOA costs increase over time

- Insurance and utility variability

- Resale and rental demand if plans change

A home that stretches these areas can reduce options later, especially for buyers who may need flexibility.

Overpaying Is a Bigger Risk for Relocating Buyers

Buyers relocating from out of state or from other parts of Washington often face additional risk because they don’t yet know how neighborhoods function day-to-day.

Without local context, it’s easy to:

- Overestimate demand in certain areas

- Underestimate commute or traffic impact

- Miss future development or zoning changes

- Assume appreciation will be uniform

That’s how buyers end up with homes that look great on paper but feel limiting later.

How to Protect Yourself From Overpaying

Avoiding overpaying doesn’t mean avoiding good homes. It means asking better questions before committing.

Smart buyers evaluate:

- How the home performs in different market conditions

- Whether it would rent or resell if needed

- How ownership costs evolve over time

- Whether the location supports long-term demand

At Operation Red Dot, we help buyers look beyond the moment and evaluate homes through a future-focused lens - especially important for buyers who value flexibility and peace of mind.

BOOK A FREE NO OBLIGATION CONSULT

A Good Purchase Holds Up Over Time

The goal isn’t to find the cheapest home or to win the fastest deal.

The goal is to buy a home that:

- Still makes sense if your plans change

- Protects future options

- Doesn’t rely on best-case assumptions

- Feels like a good decision years later

That’s how buyers avoid the kind of overpaying that only becomes obvious after it’s too late to change.

Buying With Confidence Means Thinking Past Closing

Whether you’re buying near JBLM or elsewhere in the South Puget Sound region, the biggest risk isn’t paying a little more today, it’s buying something that limits your future.

If you’re worried about overpaying and want guidance that focuses on long-term value, flexibility, and decision confidence, we’re here to help you think it through, without pressure.