Who should consider buying, and why this season may open rare opportunities

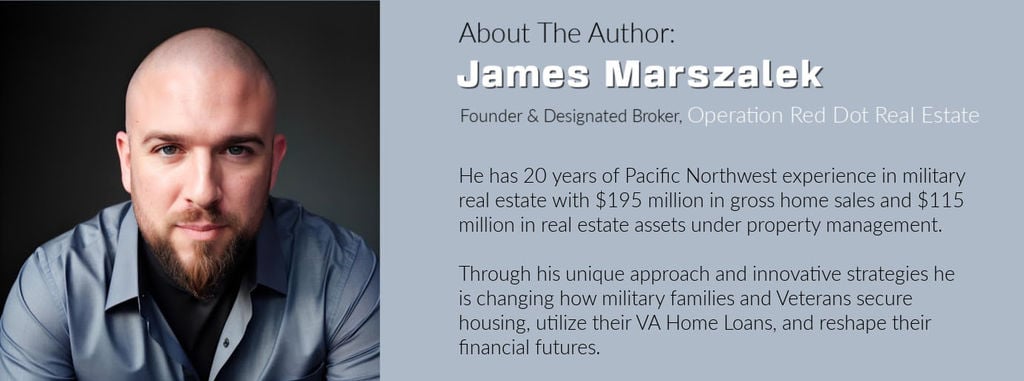

James Marszalek, Director of Sales & Client Strategy, Operation Red Dot

Winter usually brings a quieter real estate market, but Winter 2025–2026 is shaping up differently. Interest rates remain uncertain, inventory is shifting, and South Puget Sound communities continue to see steady demand. For service members on PCS orders, Veterans preparing for long-term roots, and local or incoming families planning a next chapter, this winter offers a unique moment to buy with strategy and confidence. Below is a clear guide to help you understand whether this season is the right time for your home purchase, and how to make a smart, well-timed move.

Families Planning to Stay 3+ Years

If you expect to remain in the JBLM area for at least three years, winter may be an excellent time to buy. South Puget Sound communities—including Lacey, DuPont, Puyallup, Yelm, Olympia, and Lakewood—continue to see strong, long-term home value growth. Prices have remained stable thanks to steady demand and limited new construction. Buying now lets you lock in your housing costs and position yourself ahead of any spring competition. Home values in the region tend to rise year after year. A steady market combined with access to strong community amenities provides stability, predictable payments, and a clear path toward building equity. Even modest appreciation can support your financial future if you hold the home long enough.

Retiring Service Members & Families Putting Down Roots

Winter is often overlooked, but it can be a strong season for those ready to settle permanently in the South Puget Sound Region. Communities across Pierce and Thurston Counties offer a mix of affordability, healthcare access, recreation, and strong Veteran networks. Local residents often choose this area to stay close to outdoor recreation, medical services, and base resources. Buying now offers the advantage of choosing from winter inventory without the intensity of the spring rush. It’s also a great time for those looking to downsize, upgrade, or find the home that supports their next stage of life

Dual-Income Buyers & Those Seeking Long-Term Investment Potential

Many families and individuals choose to buy in this region because the area attracts renters year-round. If you receive orders earlier than expected, a well-located home near JBLM can become a reliable rental with the help of professional property management. Strong rental demand, stable prices, and continued population growth make homeownership a solid long-term strategy. Those entering the market with financial readiness, steady income, strong credit, and emergency reserves, are particularly well positioned this winter. Even if mortgage rates remain elevated, a future refinance can make ownership more affordable.

Buyers With Savings, Equity, or Recent Windfalls

Some buyers step into winter with a clear advantage. If you recently sold a home in a high-demand region or built-up savings while living overseas, you may be able to purchase with a smaller mortgage and benefit earlier from appreciation. Strong reserves also give you flexibility to handle closing costs, appraisal gaps, or repairs. Stable income from retirement pay, dual-income households, or low debt-to-income ratios can make financing easier as well. Winter sellers may negotiate more readily, helping reduce out-of-pocket costs.

Strategies for Buying Well in Winter 2025–2026

Explore Assumable VA Loans Some sellers hold VA loans with interest rates far below current levels. With proper qualification, you may be able to assume that low-rate mortgage. This can create major monthly savings and reduce closing costs. A knowledgeable real estate team can help identify assumable VA listings and guide you through the process. Use VA Benefits to Their Fullest Advantage The VA loan remains one of the most powerful tools for military families and veterans in real estate. With no down payment, no PMI, flexible credit requirements, and competitive interest rates, it allows many families to buy sooner. For those looking to build long-term wealth, purchasing a duplex, triplex, or fourplex and living in one unit may help offset your living costs while building equity across multiple units. cost.

Buy With a Long-Term Hold in Mind

Even if you may receive PCS orders in a few years, the home you buy this winter doesn’t have to become a financial burden. South Puget Sound communities consistently attract renters. Choosing a home near base gates, major commuting routes, and strong schools gives you a future rental option, backed by local property management support if needed.

Negotiate With Confidence

Winter can bring more motivated sellers. This means opportunities for closing cost credits, rate buydowns, repair credits, or help with upgrades. The right offer can make homeownership more affordable now while keeping monthly costs manageable long-term. A skilled agent can help structure these negotiations and protect your interests.

Work With a Team That Also Understands Military Moves and Local Life

Home-buying near JBLM involves timing, logistics, and planning that differ from typical moves. Choose a team that understands the PCS process, VA appraisals, move-in timelines, and the urgency involved in relocation. Local expertise matters just as much. Every community around JBLM has its own feel, school options, commute patterns, and market behavior. A team with both military background and deep South Puget Sound experience can guide you through every step and help you act quickly when the right home becomes available.

Final Thoughts: Winter 2025–2026 Could Be Your Window

This season offers a combination of stable prices, motivated sellers, and unique loan options that don’t often align. If your financial situation is strong, your plans are clear, and homeownership is your next goal, Winter 2025–2026 may be the ideal time to step forward. It’s a chance to secure a home before the spring surge, lock in a stable monthly payment, and build long-term equity in one of the most desirable regions in Washington State.

Next Steps

- Get pre-approved through a VA-friendly lender

- Connect early with a real estate agent who understands JBLM and South Puget Sound communities

- Explore homes with assumable VA loans or flexible sellers

- Align your timeline with school years, lease transitions, or winter PCS dates

With the right plan and guidance, buying this winter can set your family up for stability, financial strength, and a confident start to your next chapter.

LEARN MORE ABOUT OUR HOMEBUYING SERVICES