Military Families Deserve Better Protection

Serving your country shouldn’t make you a target—but scammers don’t care. Military families, especially those using VA loans, are prime targets for predatory practices. Fake discounts, shady refinancing schemes, and wire fraud scams cost families time, money, and peace of mind. Here’s how to spot the traps and defend your hard-earned benefits.

How Predatory Practices Target Military Families

Scammers prey on trust and urgency, exploiting the vulnerabilities of military families who face rapid relocations. Multiple priorities and insufficient research during a PCS can pressure service members to buy quickly and regret later. PCS moves to unfamiliar areas make it harder to assess neighborhoods or property values, leaving families exposed to overpriced deals.

Beware of high-pressure sales tactics that create a false sense of urgency, pushing buyers into bad deals. Also trusting ALL military-friendly labels can be dangerous, as many scammers use patriotic branding to deceive.

And while the VA loan program is a fantastic benefit for military families, not all loan offers are good offers. Go over the structure of your loan with a loan officer as predatory lenders can hide excess fees within the loan. And explore carefully home sales offers for “military-only” that promise exclusive savings but deliver inflated home prices. And especially now, beware of bogus refinance offers claiming to reduce mortgage payments. They often pack hidden costs that strip away your home’s equity. And perhaps the most devastating of scams is wire fraud that can happen near to closing.

The Red Flags of Real Estate Scams

Spotting the signs of a scam can save you thousands. Be wary of too-good-to-be-true interest rates—if it feels off, it probably is. VA benefits never require upfront fees, so any lender asking for them is a fraud. Watch out for confusing loan terms that bury extra costs in fine print. Lastly, if anyone pressures you to waive inspections, walk away—this tactic hides costly property issues.

Wire Fraud: How It Works—and How to Stop It Before It Starts

Wire fraud is one of the fastest-growing scams targeting military homebuyers, especially near high-traffic bases like Joint Base Lewis-McChord (JBLM). Here’s how it typically goes down: scammers hack into email threads between buyers, agents, or lenders, then pose as a trusted party—often your title company. At just the right moment, they send “updated wiring instructions” for your closing funds. One click, and your life savings are gone. The money is rerouted to a fraudulent account and nearly impossible to recover.

Spotting wire fraud isn’t always easy, but there are red flags. ANY change to wire instructions during your transaction is a RED FLAG, especially via email. Always verify by calling your title or escrow officer and real estate agent using a phone number you know is correct—never trust contact info from the suspicious email. At Operation Red Dot, we educate JBLM-area homebuyers on these exact tactics and work only with title teams who follow strict verification protocols. When it comes to your home and your hard-earned money, trust but verify—every time.

Smart Moves to Protect Yourself

The best defense against scams is preparation. Only work with VA-approved lenders who have a track record of honesty. Know your benefits—VA loans are powerful tools, but they have limits. Read every line of your contract and seek clarification before signing. And when in doubt, get a second opinion from a trusted advisor or real estate expert.

Military families face real estate scams daily—but knowledge is power. By spotting the red flags, preparing wisely, and partnering with trusted experts, you can protect your investment and your future. Don’t let scammers steal the home you fought for. Contact Operation Red Dot for expert guidance that protects your family and honors your service.

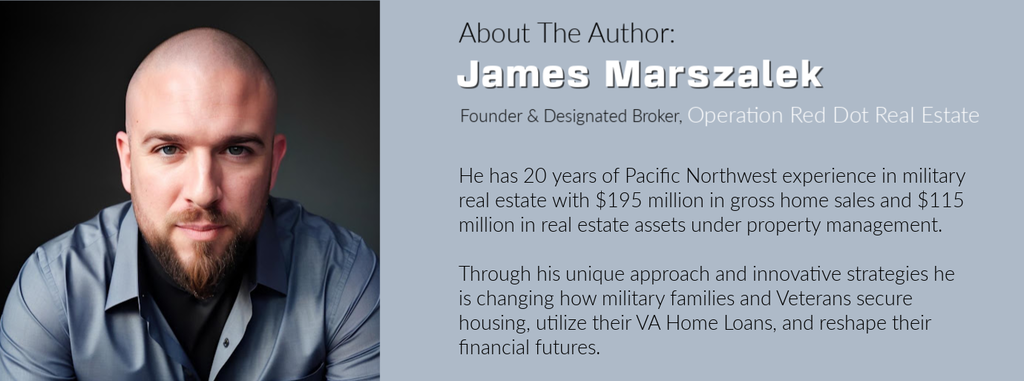

How Operation Red Dot Protects Military Homebuyers

At Operation Red Dot, we fight for military families. Our team, led by veterans, understands your unique challenges. We connect you with reputable, VA-approved lenders to ensure you get fair, transparent financing. We prioritize full transparency—no hidden fees, no surprises—just honest guidance. And when PCS orders come fast, we move faster, helping you buy with confidence, no matter the timeline.